Spring 2021

Hope for New Beginnings

Dear Valued Members,

It’s hard to believe it has been one year since the COVID-19 pandemic changed our lives. I hope that you and your loved ones have remained safe and healthy during this challenging time. As the pandemic extends into its second year, we continue to make the safety of our members and employees our highest priority.

It’s hard to believe it has been one year since the COVID-19 pandemic changed our lives. I hope that you and your loved ones have remained safe and healthy during this challenging time. As the pandemic extends into its second year, we continue to make the safety of our members and employees our highest priority.

As Los Angeles and Ventura Counties continue to open, we remain guided by the requirements of public health authorities, as well as state and federal mandates regarding reopening businesses. Currently, we’re required to limit the number of members allowed inside a branch at any given time to ensure safe distancing. For everyone’s safety, we require members and employees to wear face masks while inside of our branches.

The steep decline in COVID-19 cases and availability of vaccines to every adult in California beginning April 15, gives us hope that the communities we serve will begin to emerge from the pandemic this year.

We Are Here To Help You Thrive

Low interest rates, an upswing in home sales and an energetic real estate market are driving members to Logix in droves to refinance existing mortgages or to obtain new home loans. We expect the housing market to remain competitive this year driven by low real estate inventory coupled with high demand, which will continue to drive prices higher.

According to many of the nation’s economists, the economic growth for 2021 is expected to be stellar. This means that today’s loan rates are likely to rise, so it’s a really good time to lock in a low rate on your mortgage soon. It’s also a good time to tap into your home’s increased equity to pay off bills, make home renovations or to pay for that long craved-for post-pandemic vacation to create new family memories. The Logix team is ready to guide members through every step of the home-loan process and our new state-of-the-art mortgage system makes the experience faster and easier than before.

We have many other loan programs that will put you in a better financial position, including vehicle and personal loan rates as low as 1.49% APR and 6.24% APR, respectively, on approved credit.

A New Home for Logix

We’re very proud to share that we’re scheduled to open doors to the new Logix headquarters in Valencia, CA in May 2021. The campus is located on Franklin Parkway, near the junction of Interstate 5 and State Highway 126.

As a fast-growing hub of business and new housing development, we determined the Santa Clarita Valley (SCV) to be the best site for the company’s long-term growth while also offering our employees a great quality of life. With 5 branches and over 30 years of history in the SCV, our staff is looking forward to being even more involved in the community.

The Logix campus includes a 180,000 square foot headquarters building with a bright open floor plan, a commissary, state-of-the-art data center, generously sized work stations and indoor and outdoor collaboration spaces and amenities to complement our culture of belonging, purpose, meaning and overall employee wellness. In the coming years, we’re hoping to attract talent from the Santa Clarita Valley as one of the largest employers in the community. For many, it’s a dream come true to live and work in the same community.

Logix Federal Credit Union remains committed to serving you and the communities we serve. We know that it will be several months before the pandemic is behind us and that many small businesses and households in our communities will need time to rebuild. Please reach out to us for assistance with any financial hardships you may be experiencing.

Thank you for your continued trust in Logix!

Sincerely

Ana E. Fonseca

President and CEO

Logix Rates

Accurate as of April 1, 2021

Auto Loans

New Auto Loans

As low as

1.49% APR

Used Auto Loans

As low as

1.74% APR

4 Reasons to Buy a Home This Year...

and 3 Reasons You Should Continue to Rent

Every 12 months, you need to decide whether to breathe new life into your rental agreement or let it expire. You could resuscitate your relationship with your landlord (again) or allow it to rest in peace and join the growing ranks of first-time homebuyers ready for a long-term commitment.

agreement or let it expire. You could resuscitate your relationship with your landlord (again) or allow it to rest in peace and join the growing ranks of first-time homebuyers ready for a long-term commitment.

According to the National Association of Realtors®, first-time buyers are grabbing a greater share of the real estate market, despite the pandemic. It might be due to the changing workplace, a renewed appreciation for home life, or one of the four reasons we list below. While buying a home isn't the right decision for everyone, there's a strong case for seriously considering a home purchase this year.

- Mortgage interest rates are at record lows.

Last year, interest rates fell to record lows to help stimulate the economy. This was good news for borrowers, as lower rates decrease the cost of borrowing money for a home. Mortgage rates remain below 3% for now, but they won't stay that way forever. According to Freddie Mac, mortgage rates are already starting to rise as the economy shows signs of improvement. Buying a home now means you can take advantage of today's low interest rates. Find out more about Logix mortgage rates here.

- Homeownership can provide substantial tax benefits.

Despite the tax deduction limitations placed on mortgage interest and points in 2018, homeowners can still use their mortgage to help lower their tax bill. The effect each deduction will have on your taxes is based on the property and your financial situation. As a homeowner, you'll have access to tax breaks that aren't available to renters. But consider hiring a tax professional to help you understand your unique tax situation.

- Home prices continue to rise amid a shrinking inventory.

According to the National Association of Realtors®, home prices are rising and inventory is shrinking. The median price for existing homes is up 14.1% from this time last year, while the number of units is down by 25.7%. You can get more home for your money now, before prices increase even more.

- Employers are embracing remote working.

The pandemic proved that employees can be just as effective working from home as they are in the office. And many employers have adopted policies that support their employees' choice to continue to work at home even after it's safe to return to the office environment. Since many workers no longer need to live near work, moving into the suburbs or another city has become an attractive option. If your employer allows you to work from home or telecommute a few days a week, you may be able to remove "close to work" from your home-buying wish list. Read more on this topic on the Logix SmartLab blog.

Three Reasons to Keep Renting

- You have plans to move out of the area soon.

Buying a home is a huge financial commitment. While the competitive housing market might allow you to sell your home quickly, you may not recoup the amount you pay toward your down payment, closing costs, and upgrades to the new home.

-

You're not ready to give up the perks of renting.

Homeownership is a big responsibility, and the costs extend far beyond the mortgage, insurance, and property taxes. Leaky faucets, broken appliances, and low water pressure showers will no longer be fixed with a call to the property manager. When you own your home, you not only pay out-of-pocket for all maintenance and repairs, but you have to find qualified people to do those things if you don't have the know-how and skills to do them yourself.

Also, homeowners must travel miles or even pay money to access certain pet, recreational, and parking amenities available onsite at many popular apartment units. Examples include a dog park, electric car charging stations, and a fitness center. And paying rent on time can even help you build a positive credit history.

-

You’re Elon Musk.

I am selling almost all physical possessions. Will own no house.

— Elon Musk (@elonmusk) May 1, 2020

Saying goodbye to renting is a huge financial step, but it has the potential for even greater rewards. Homeowners can access significant tax savings, build equity in an appreciating asset, and put an end to rent increases once and for all. Logix has a variety of home loan programs to fit your budget. Call us or visit our website today and ask about the special mortgages we have to help new homebuyers.

Beyond Retirement:

Consider Your Other Goals

Retirement savings isn’t the only financial goal you might want to consider in a lifetime. There are other considerable milestones that you want to take into account as well.

When it comes to financial stability, people tend to focus on paying off debt and saving for retirement. In reality, many other financial goals beckon to individuals during their lifetime. Because of this, it’s important to look beyond retirement when setting targets, no matter how old you are.

Identify Future Objectives

While it is never too early to start planning for retirement, waiting until you reach 65 years or older to truly live is a mistake many people come to regret. A number of exciting possibilities are waiting for you throughout your life:

- Creating and growing passive income

- Starting a business

- Owning a home

- Becoming debt-free

- Raising a family

Consider Income

Some people start their careers making six figures or more; this is rare. By about 25 years old, making $35,000 or so is a reasonable expectation. If your salary increases follow the historical rate and you have no major employment gaps, from 25 years to the time you’re ready for retirement you could earn almost $2 million.

Without a doubt, $2 million is a lot of money. If you take a second look at the list of potential financial goals, however, it begins to lose its comparative value. For instance, the current cost of a starter home is anywhere from $150,000 to $250,000. Similarly, student loans are one of the biggest obstacles to a debt-free life. The average student loan debt is $29,800.

Create a Plan

If you’re starting to feel discouraged, the good news is that money isn’t a static asset. It has the potential to grow and do some of the work for you by creating passive income. In fact, people who begin to invest in their future early can better position themselves in the pursuit of their retirement goals. You can employ several different strategies to help your money go further:

- Designate a portion of raises: Instead of increasing living expenses to match any pay increases, try to retain the original budget as much as possible and invest the extra. Keep the same starter home you bought. Drive your present car for as long as possible.

- Start small: Not everyone is making $35,000 per year at age 25. Some people make significantly less throughout their earning years. The answer to this economic problem is to start small. Save $100 per month if you can and $10 per month if you can’t. It all adds up, especially when properly invested. In 10 years, $100 per month at a 6% annual return could potentially grow into $15,996. (This is a hypothetical example and is not representative of any specific situation. Your results will vary. The hypothetical rates of return used do not reflect the deduction of fees and charges inherent to investing.)

- Buy wisely: When you purchase a vehicle or buy a home, consider the maintenance cost and tax breaks. For instance, is it better to invest in solar panels than a new sunroom for your home? Likewise, consider the potential tax or economic benefits of a small electric vehicle or hybrid over a new mid-size SUV.

- Make use of programs and incentives: There are many financial products and accounts available that could help you invest your money in a tax-efficient manner. These include HSA accounts, 401(k)s, Individual Retirement Accounts (IRAs) and 529 college savings plans. Taxes can have a big impact on passive income. It is important to manage their impact over a lifetime.

Reduce Debt

The best time to start minimizing debt is before you take any on. This does not mean you should never buy anything on credit. It does imply wisdom in how you use debt. Also, be wise about payment terms, interest rates and the types of debt.

Whenever possible, pay down that debt as quickly as you can. However, never become so focused on paying off debt that you neglect your savings. Take another look at the list of potential financial goals and see how you can get closer to those goals.

Need help figuring out where to get started? Our Financial Consultants at Logix Financial Services can help. Call us at (800) 553-3707 for more information today.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

2. https://studentloanhero.com/student-loan-debt-statistics/

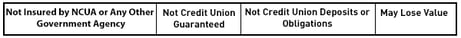

The Financial Consultants of Logix Financial Services are registered representatives with, and securities and advisory services are offered through LPL Financial (LPL), a registered investment advisor and broker/dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. Logix Federal Credit Union (LFCU) and Logix Financial Services are not registered as a broker/dealer or investment advisor. Registered representatives of LPL offer products and services using the name Logix Financial Services, and may also be employees of LFCU. These products and services are being offered through LPL or its affiliates, which are separate entities from and not affiliates of LFCU or Logix Financial Services. Securities and insurance offered through LPL or its affiliates are:

CA Insurance License #0D64827

IRS to Make ID Protection PIN Open to All

The U.S. Internal Revenue Service (IRS) reported at the beginning of 2021 it will allow all taxpayers to apply for an Identity Protection  Personal Identification Number (IP PIN), a single-use code designed to block identity thieves from falsely claiming a tax refund in your name. Currently, IP PINs are issued only to those who fill out an ID theft affidavit, or to taxpayers who’ve experienced tax refund fraud in previous years.

Personal Identification Number (IP PIN), a single-use code designed to block identity thieves from falsely claiming a tax refund in your name. Currently, IP PINs are issued only to those who fill out an ID theft affidavit, or to taxpayers who’ve experienced tax refund fraud in previous years.

Tax refund fraud is a perennial problem involving the use of identity information and often stolen or misdirected W-2 forms to electronically file an unauthorized tax return for the purposes of claiming a refund in the name of a taxpayer.

Victims usually first learn of the crime after having their returns rejected because scammers beat them to it. Even those who are not required to file a return can be victims of refund fraud, as can those who are not actually due a refund from the IRS.

Many of the reasons why refund fraud remains a problem have to do with timing, and some of them are described in more detail here. But the short answer is the IRS is under tremendous pressure to issue refunds quickly and to minimize “false positives” (flagging legitimate claims as fraud) — even when it may not yet have all of the information needed to accurately distinguish phony filings from legitimate ones.

One way the IRS has sought to stem the flow of bogus tax refund applications is to issue the IP PIN, which is a six-digit number assigned to eligible taxpayers to help prevent the use of their Social Security number on a fraudulent income tax return. Each IP PIN is good only for the tax year for which it was issued.

But up until now, the IRS has restricted who can apply for an IP PIN, although it has over the past few years issued them proactively to some taxpayers as part of a multi-state experiment to determine if doing so more widely might reduce the overall incidence of refund fraud.

The IRS says it will make its Get IP PIN tool available to all taxpayers in mid-January. Until then, if you haven’t already done so you should plant your flag at the IRS by stepping through the agency’s “secure access authentication” process.

Creating an account requires supplying a great deal of personal data; the information that will be requested is listed here.

The signup process requires one to validate ownership of a mobile phone number in one’s name, and it will reject any voice-over-IP-based numbers services such as those tied to Skype or Google Voice. If the process fails at this point, the site should offer to send an activation code via postal mail to your address on file.

Source: IRS.gov

Member Service Officer, Tirzah Castillo, was acknowledged by a coworker that had a member who called in due to FedEx not being able to deliver her check form the loan proceeds. Tirzah called FedEx and worked it out direction for the member. The loan officer was going to call FedEx; however, Tirzah realized there were only two loan officers to help members and stepped up to complete everything for him. The loan officer said in response to Tirzah's coming to the rescue, “She helped me in my time of need, and in-turn helped us keep our service level up for members."

Each month our members and our employees send in employee nominations when they experience great customer service. Logix employees get to participate and vote for the favorite Service Champion of the month. You can participate by mentioning your favorite Logix staff member in a review on Yelp, Facebook, or Google!

Refer friends and family

and earn extra cash!

Consolidating at 6.24% APR?

Consolidating at 6.24% APR?

That's an impressive rate of descent!

At Logix, we want to break down the barriers between you and your dreams. Need a vacation? We’ll help make it affordable. Bogged down by a high interest loan? We’ll lift that weight from your shoulders. Maybe a wedding’s on the horizon? We’ll help make your special day just what you’ve always wanted. With a personal loan from Logix, you can say good-bye to your debts and hello to your dreams.

Whether you’re looking for the most competitive rates or a dependable monthly payment, you can look to our personal loans. There’s a reason we doubled the amount of loans we issue, and it’s because members know we put them first. There are many benefits to getting a personal loan from Logix:

- Low interest rates. Our rates are as low as 6.24% APR*. With a low rate, you can pay off your high-interest loans and get out of debt sooner.

- Fixed payments that never change. Surprises aren’t fun when it comes to payments. Depend on the same, reliable payment throughout your loan term.

- No prepayment penalties. Why should you be penalized for paying off your debt quickly? You won’t be charged any fees for making early payments.

- Terms up to 84 months. Pay off your debt across a span of time that works for you.

Ready to take out a loan? Apply today or visit our website.

*”As low as” 6.24% APR (Annual Percentage Rate) is our best rate on approved credit and includes a 1% discount for Automatic Payment (AutoPay). Rate subject to increase if AutoPay is discontinued. Actual interest rate offered may be higher depending on applicant’s credit rating. Monthly payment at 6.24% APR for 36 months is estimated at $30.53 per $1,000 borrowed. Rate accurate as of 3/1/2021 and is subject to change.

Logix membership required.

NMLS ID 503781

Federally Insured by NCUA