Summer 2021

A Letter From Our CEO

Dear Valued Members,

As our economy reopens, many of us will make up for lost time by spending on the experiences we’ve missed out on in the past 16 months. A return to normal includes travel, concerts, dining at restaurants and family reunions. I recently read that as many as 70% of Americans are planning at least one post-COVID splurge purchase and that 60% of Americans are planning to spend more on vacations. Naturally, it made me think about how Logix can help our members spend wisely and emerge from the pandemic financially well. After all, providing members with superior value and trusted advice is the reason Logix exists.

Financial Value

Whether your splurge purchase plans include a new vehicle, a new home or an exotic vacation, we can help you save money with a Logix loan. If you’re a saver and would like to increase your earnings, we can help you with that as well. I included a short list of options below but we offer many others.

- Vehicle Loans: Our rates are some of the lowest around and you may qualify to defer your first three payments.

- Credit Cards: Earn up to 3x rewards points on your purchases with the Logix Platinum Rewards credit card.

- Mortgages: Our rates remain at all-time lows. Obtain low monthly mortgage payments by financing your home purchase or refinancing your existing mortgage with us.

- Financial Advice: Our Financial Consultants will partner with you to create and manage your investment plan.

More Convenience

A lot has changed during the pandemic but our commitment to you is stronger than ever. We have been working hard to deliver on our promise to increase convenience. Cardholders will soon be able to reset the card PIN and request line increases on the mobile app. Zelle, the digital person-to-person payment solution, will be available in September. Members love our Platinum Rewards credit card because they earn up to 3 points for every dollar spent. We want more of our members to benefit from these rewards so Logix cardholders will soon be able to have both of our credit cards, Platinum and Platinum Rewards. Finally, we will soon offer a smarter way for members to easily switch direct deposits and recurring payments from external accounts to a Logix account.

Thank you for your Trust

We are proud to again be named one of America’s Best-in-State Credit Unions by Forbes and Statista. Less than 1% of credit unions nationwide can say they have received this honor each year since it was established in 2018. Receiving this recognition for the fourth year running is a huge honor for us. For our members to continually vote Logix best, especially after all of the challenges of the past year, demonstrates the level of trust you place on banking with us. It is our privilege to serve you.

We wish you and your loved ones a wonderful summer! We appreciate your ongoing trust and confidence in Logix.

Sincerely,

Ana E. Fonseca

President and CEO

5 Reasons to Buy a Car This Summer

Whether your summer plans include weekly trips to the drive-in theatre or a cross-country road trip, your current set of wheels might not be up to the task. But after more than a year of financial uncertainty, buying a car right now may seem risky. Spoiler alert - it looks like the economy may be the next summer blockbuster. Now might be the perfect time to grab your ticket and hop into a new ride.

Here are five reasons to shift gears and head to a dealership this summer.

- Interest rates are still at record lows.

Offsetting the steady rise in prices are the record low interest rates available to qualified buyers. As the economy makes a comeback, interest rates are expected to remain low until 2023. However, there are no guarantees when rates will increase or by how much. Rock-bottom interest rates make purchasing a new or used car this summer more affordable. Low rates typically result in lower monthly payments and lower overall payments during the loan term.

- You're feeling the stimulus effect.

Delayed vacations, more meals eaten at home, and several rounds of federal economic impact payments might have given your savings account balance an unexpected boost. A recent analysis found that U.S. households saved more

money with each subsequent round of stimulus payments. These funds could be used as a down payment on a new or used vehicle. The more money you put down, the less you'll need to borrow.

money with each subsequent round of stimulus payments. These funds could be used as a down payment on a new or used vehicle. The more money you put down, the less you'll need to borrow. - Prices will likely rise.

Similar to the housing market, a limited supply and large number of ready buyers drive up prices. Car manufacturers can't keep up with the demand for new vehicles right now because of the shortage of microchips, a necessary component for today's relatively high-tech rides. This leaves consumers with a smaller inventory of new and used vehicles. Since no one knows when the shortage will end, buying a car now could help you avoid paying higher prices in the next few months.

- Dealer incentives might disappear.

A limited vehicle supply could also mean fewer deals and buyer incentives. According to J.D. Power, dealer incentives have dipped by 7.5% from where they were in April 2020. Despite higher prices and fewer incentives, consumers still made April 2021 a record-setting month for new car purchases. With new vehicle sales showing no signs of slowing down, there's little need for dealers to offer special deals or buyer incentives.

- Your trade-in might be worth more.

A reduced new car inventory is fantastic news if you're looking to trade up as many dealerships still need to fill their lots with used cars and trucks. It's possible to trade in your vehicle today and receive more than you would have at the same time last year. If you were one of the millions of Americans who drove less in 2020, your vehicle might have a higher resale and trade-in value thanks to the lower odometer reading and reduced wear and tear it's been through.

Set your wheels in motion with a low-interest rate Logix auto loan. With rates starting as low as 1.24% APR for new vehicles and 1.49% APR for used vehicles, you could be behind the wheel and cruising down the highway sooner than you think.

Plus, with our Relationship Rewards Program members can get a loan as low as 0.99% APR for the first time ever!

Wealth Building Strategies

While Raising a Family

Raising a family is rewarding and expensive. Consider taking these steps to support your family financially through a program of smart investing.

Building a career and raising a family requires management skills. Juggling your time, priorities, and money now while planning for the future can be daunting. Saving now to send your kids to college, take care of your parents as they age, and pursuing a comfortable retirement can be challenging.

Savings alone may not be enough. Saving part of your monthly income is the first step toward building wealth, but with current interest and inflation rates, saving may not be able to do the job on its own. After putting aside enough cash for an emergency fund, you may want to consider investing in a diversified set of investments such as stocks, bonds, mutual funds, real estate, and more. Logix Financial Services Financial Consultants can show you how to match your investment portfolio to your tolerance for risk, age, goals, and income to help you build your wealth.

Start with building your retirement nest egg. Most often, parents put their children’s future first by building a college fund. While this is certainly important, preparing for retirement should take precedence. Your children have options that you don’t. Your kids can use a combination of savings, loans, and scholarships to attend college. You must live on Social Security and the wealth you’ve accumulated. The last thing you want is to depend on your children’s financial support when they begin working and you stop.

Use the tax code to help build wealth. If you’re covered by a qualified employer retirement plan, not only should consider making the largest contributions you can afford, you should make sure the money is invested in assets with the potential to provide long-term growth. If you are self-employed or not covered at work, consider an Individual Retirement Account (IRA) and/or Self-Employed 401(k), preferably self-directed ones, to hold your investment portfolio. Not only are contributions tax-deductible each year (subject to income and contribution limits), but all your earnings are tax-deferred until you start making withdrawals. You can delay withdrawals until age 70½, giving you many years of tax-deferred growth potential.

Take advantage of other tax breaks. While contributions to a 529 education savings plan are not deductible from your taxes, growth is tax-deferred, and if used for qualified educational purposes, withdrawals are tax-free. Your employer may offer tax-advantaged benefits like cafeteria plans. As your wealth grows, consider if it’s appropriate to allocate money into investment vehicles like tax-free municipal bonds*, Treasury Inflation-Protected Securities, whole life insurance, Real Estate Investment Trusts (REITs), and qualified annuities, to name a few.

How you invest your money is critical to the financial health of you and your family. Allow one of Logix Financial Services Financial Consultants to help you build wealth while raising a family.

Need help figuring out where to get started? Our Financial Consultants at Logix Financial Services can help.

Source/Disclaimer:

*Interest income may be subject to the alternative minimum tax. Municipal bonds are federally tax-free, but other state and local taxes may apply.

There is no guarantee that a diversified portfolio will enhance overall returns or outperform a nondiversified portfolio. Diversification does not protect against market risks.

Qualified accounts such as 401(k)s and traditional IRAs are accounts funded with tax deductible contributions in which any earnings are tax deferred until withdrawn, usually after retirement age. Unless certain criteria are met, IRS penalties and income taxes may apply on any withdrawals taken prior to age 59½. RMDs (required minimum distributions) must generally be taken by the account holder within the year after turning 72.

Prior to investing in a 529 Plan investors should consider whether the investor’s or designated beneficiary’s home state offers any state tax or other state benefits such as financial aid, scholarship funds, and protection from creditors that are only available for investments in such state’s qualified tuition program. Withdrawals used for qualified expenses are federally tax free. Tax treatment at the state level may vary.

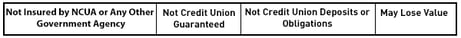

The Financial Consultants of Logix Financial Services are registered representatives with, and securities and advisory services are offered through LPL Financial (LPL), a registered investment advisor and broker/dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. Logix Federal Credit Union (LFCU) and Logix Financial Services are not registered as a broker/dealer or investment advisor. Registered representatives of LPL offer products and services using the name Logix Financial Services, and may also be employees of LFCU. These products and services are being offered through LPL or its affiliates, which are separate entities from and not affiliates of LFCU or Logix Financial Services. Securities and insurance offered through LPL or its affiliates are:

CA Insurance License #0D64827

Join Us for Concerts in the Park

Join Us for Concerts in the Park

The City of Santa Clarita’s Concerts in the Park series, presented by Logix Federal Credit Union, is scheduled to return this summer. Now, Saturday nights in 2021 at Central Park will include a free concert from July 3 to August 28 with a variety of performers.

This year’s lineup is the best yet and features tributes to fan favorites, such as David Bowie, Bruce Springsteen and The Rolling Stones. Each show begins at 7 p.m., allowing concertgoers to relax with family and friends as the sun sets. Mark your calendar for these dates and performers:

- July 3: The PettyBreakers: A Tribute to Tom Petty

- July 10: Hollywood U2: A Tribute to U2

- July 17: AbbaFab: A Tribute to ABBA

- July 24: Space Oddity: A Tribute to David Bowie

- July 31: The Rising: A Tribute to Bruce Springsteen

- August 7: Non-City Event at Central Park

- August 14: The Lao Tizer Band: Latin Jazz

- August 21: The WHO Invasion: A Tribute to the WHO

- August 28: Mick Adams and the Stones: A Tribute to The Rolling Stones

Each week will feature several area business vendors and a Logix booth. Stop by and say hello to our friendly staff.

For more information this concert series, please visit santa-clarita.com/concerts or email aeo@santa-clarita.com.

*Please note, the city will adhere to any/all Los Angeles County and State guidelines to keep the community safe.

Going above and beyond

for our members.

Andre, from our Bridgeport branch, was complimented by existing members that had referred their daughter for a private party purchase. He assisted with opening the account and walked her through the process and even made time the same day for the seller to come in to wrap up the deal. When the seller arrived however, there was an issue with title and our new member and her mom felt uncomfortable proceeding. The seller kept trying to pressure our members with proceeding but Andre explained the concerns and the steps needed to remedy the title. After the sellers left, our new member and her mom stayed behind to thank Andre for looking out for them as well as taking the time to explain what the seller needed to do. They will go to Andre from now on as he was so helpful and genuine.

Andre, from our Bridgeport branch, was complimented by existing members that had referred their daughter for a private party purchase. He assisted with opening the account and walked her through the process and even made time the same day for the seller to come in to wrap up the deal. When the seller arrived however, there was an issue with title and our new member and her mom felt uncomfortable proceeding. The seller kept trying to pressure our members with proceeding but Andre explained the concerns and the steps needed to remedy the title. After the sellers left, our new member and her mom stayed behind to thank Andre for looking out for them as well as taking the time to explain what the seller needed to do. They will go to Andre from now on as he was so helpful and genuine.

Refer friends and family

and earn extra cash!

Oversharing On Social Media:

If Opportunity Knocks, Know When Not To Answer![]()

Sharing online can be irresistible, especially when quizzes, surveys and other fun opportunities allow your voice to be heard. It’s important to note that bad actors are constantly trolling social media sites for personal information. One of their biggest allies are the viral social media quizzes and surveys that pop-up on sites like Facebook. They give hackers gold nuggets of information that can be used for future cyberattacks. With online quizzes and oversharing providing the fuel for an attack, knowing it’s avoidable to begin with is perhaps most disturbing of all.

Brute force attacks on passwords succeed 50% of the time when the twenty-five most commonly used passwords are tried on a user account. Weak passwords aside, oversharing leads to hackers using that information to guess security questions and passwords. Posting the name of a pet, the high school you attended, or your best childhood friend can give hackers answers to account security questions. Also, by using automated bots, attackers can brute force a password with little effort.

How to Defend Against Brute Force Attacks

- Increase password length

- Increase password complexity

- Limit login attempts

- Implement Captcha

- Use multi-factor authentication

Socially engineered attacks, like those using targeted email phishing, are often done using information gleaned from social media posts. Sharing that you’re an advocate for homeless animals can give a hacker a number of attention-grabbing email subject lines. The email content can include a link to a fake website and malware-filled attachments for you to open. They can also send emails that appear to be from a friend – a friend whose email account they have hijacked.

Physical crimes against private property can also be assisted by oversharing. Posting the address of your new home can, at some point, be put together with posting current vacation photos and can give a criminal the green light to enter your home knowing you’re not there. Hackers are particularly good at putting tidbits of information together, and you, your social media posts and possessions are not immune.

5 Common Types of Phishing

- Email Phishing

- Spear Phishing

- Clone Phishing

- Whaling

- Pop-Up Phishing

Tips for Smart Sharing

-

Resist answering social media surveys and quizzes whenever possible, especially those asking for passwords and other personal information; be aware of coupon and promotional scams sent by those other than the official retailer; don’t follow email links or open attachments from unknown senders, and since hackers can steal email addresses from those you trust, it should be verified with the sender before acting on them.

-

It helps to think like a hacker before posting information, meaning: Can someone use your shared information against you? Does a posted picture show your address, car license plate, credit card, or driver’s license? Remember, it’s easy to enlarge a photo until even the smallest details are visible.

-

Keep anti-virus and other device software updated with the latest versions; enable 2FA (two-factor authentication) whenever possible, especially for social media sites; check that a site is properly secured with a URL that begins with “https” (the “s” at the end is a sign a site is secure) and has the lock icon on the address bar; check and double-check the URL spelling as hackers can drive you to a cleverly misspelled, exact duplicate website they control; never download apps from third party websites and get them only from the official Google Play and Apple App Store sites, or the official store for your device.

Traveling This Season?

Add This to Your Packing List

As COVID-19 restrictions ease, get ready to check off another box on your bucket list of travel destinations. Whether you intend to fly the friendly skies, hop on a train, or cram overflowing suitcases into your SUV, forgetting to pack your most important travel companion could put you in an awkward situation.

No, we're not talking about your toothbrush. This is about your Logix Platinum Rewards Mastercard®. Neglecting to add it to your mobile wallet could cause just as much embarrassment though — and be much more costly.

Enjoy a change of scenery and experience these trip perks when you use your Logix Platinum Rewards Mastercard:

- Skip the lines by using your reward points to purchase TSA PreCheck®.

- Stress less about canceled or interrupted trips, with Trip Cancellation Insurance.

- Feel like royalty with Mastercard Airport Concierge services.

- Rent a car with fewer worries with Auto Rental Coverage.

- Earn 10,000 bonus points when you spend $1,000 in purchases in 90 days.

- Earn up to 3 points for every dollar spent with your Logix Relationship Rewards status.

Keep your travel cash in your Logix account. These benefits are free.

When you return from your well-deserved R&R, use the points you earned on your trip to guide your next adventure. Create a custom travel package for later in the season or save up your points for the holidays. Redeem points for airline flights, hotel stays, car rentals, cruises, and more!

- Flights - Over 125 airlines to choose from

- Hotels - More than 160,000 hotel and resort properties worldwide

- Car Rentals – A variety of makes and models from all major brands in 195 countries

- Activities – Stay and play with over 10,000 tours and activities in 400 top destinations

Let your points take you places when you apply for a Logix Platinum Rewards Mastercard today!

Digital Wallets with Logix

An Easy and Secure way to Pay

If you’re ready to simplify your life, consider using a digital wallet instead of a physical wallet. A digital wallet is an app that lets you keep your credit and debit cards on your smart device: choose from Apple Pay®, Google Pay™, or Samsung Pay.

You can expect the same trustworthy service from Logix when using a digital wallet of your choice, plus you will enjoy all the rewards, benefits, and protections your Logix Mastercard credit and debit cards offer.![]()

Make Purchases Quickly and Safely

When you shop with a digital wallet, your information is secure and transactions are encrypted. Instead of using your actual card number at checkout, a unique Device Account Number is assigned. You can add another layer of security by requiring a PIN, fingerprint, or other authenticator for your device.

Shopping and saving is simplified when you keep loyalty cards, digital coupons, and gift cards in your digital wallet. Enjoy a faster check out experience in stores, online, and within apps.

-

In stores: Digital wallets use near-field communication technology so there’s no waiting for the chip reader, swiping, or signing. Find the contactless reader or the logo of your digital wallet app. Then unlock your device, hold it near the payment terminal, and follow the prompts.

-

Online: You will no longer need to enter your card number or shipping address when you shop online. The digital wallet safely stores all your personal information.

-

Within apps: With just a touch, you can order a meal, buy your pet’s favorite treats, or hail a ride.

Easy Setup

In just a few steps, you can be on your way to a great shopping experience. First, check to see if a digital wallet app is installed on your device. If not, visit our Digital Wallets page for more information.

Choose the app that’s right for you and follow the step-by-step instructions. If you need help or have any questions, contact us online or by phone.

Your ability to use Apple Pay, Samsung Pay, or Google Pay may not be available at all locations where your Logix card is accepted. Apple Pay is a trademark of Apple Inc. Google Pay is a trademark of Google LLC. Samsung Pay is a trademark of Samsung Electronics Co., Ltd. Logix Federal Credit Union is not affiliated with and is a separate entity from Apple Inc., Samsung Electronics Co. Ltd., and Google LLC. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.

Special Notice:

All Lockheed Martin Retirees and Former LM Employees

Now is your opportunity to keep in touch with retired co-workers/former employees and LM friends. You are invited to join the LM Star Dusters retiree organization. Benefits include an informative monthly newsletter which includes corporate and retiree news, notice of social gatherings, access to a membership roster, plus other helpful articles and information of interest.

For more information and/or a membership application, call (888) 718-5328, ext. 2011,

visit lmstardusters.org or write to:

Star Dusters

P.O. Box 10310

Burbank, CA 91510-0310

We look forward to hearing from you.

NMLS ID 503781

Federally Insured by NCUA